Table of Contents

- Overview

- Key Features

- Installation Guide

- Usage Guide

- Parameters

- Core Formula

- GitHub Repository

- License

Overview

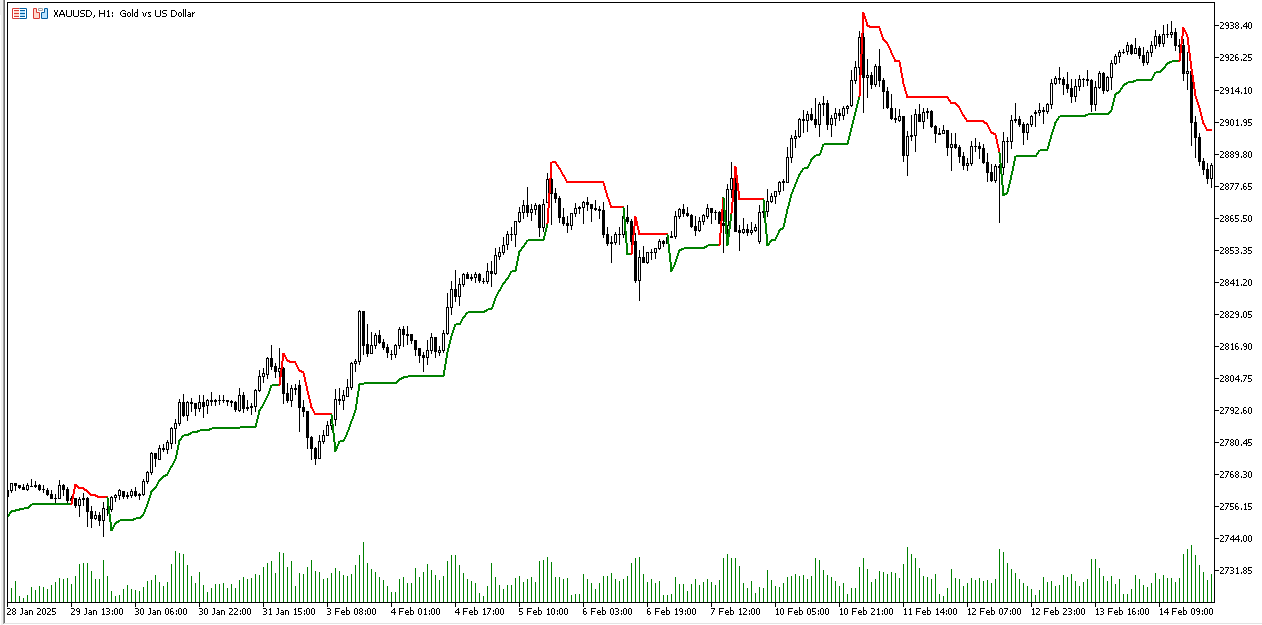

The SuperTrend indicator is a powerful technical analysis tool for MetaTrader 5 that helps identify market trends based on Average True Range (ATR) volatility. Released under the MIT license, this free and open-source indicator provides traders with a reliable way to spot trend direction and potential reversal points.

Key Features

- Trend Identification: Clear visual signals for uptrends and downtrends

- ATR-Based Volatility: Dynamic adjustment to market conditions

- Customizable Parameters: Adjust sensitivity and calculation methods

- Multi-Timeframe Support: Works on any timeframe

- Open Source: Free to use and modify under MIT license

- Easy Integration: Simple installation process

- Visual Clarity: Color-coded signals for quick analysis

Installation Guide

- Download the

supertrend.mq5file from our GitHub repository - Copy the file to your MetaTrader 5 indicators folder:

- Typically located at

Terminal_Directory\MQL5\Indicators\

- Typically located at

- Restart MetaTrader 5 or refresh the Navigator panel

- Drag the indicator onto any chart

Usage Guide

Trend Following

- Buy Signal: When the SuperTrend line turns green and moves below price

- Sell Signal: When the SuperTrend line turns red and moves above price

- Exit Signal: When the line changes color, indicating a potential trend reversal

Trading Strategies

-

Trend Following:

- Enter long when SuperTrend turns green

- Exit when it turns red

- Use as a trailing stop mechanism

-

Reversal Trading:

- Look for color changes to identify potential reversals

- Combine with other indicators for confirmation

- Use on multiple timeframes for stronger signals

-

Risk Management:

- Use the SuperTrend line as a dynamic stop-loss level

- Adjust position size based on ATR volatility

- Consider market conditions when setting parameters

Parameters

ATRPeriod

- Default: 22

- Description: Period for Average True Range calculation

- Usage: Higher values for smoother signals, lower for faster response

Multiplier

- Default: 3.0

- Description: ATR multiplier to adjust sensitivity

- Usage: Higher values for fewer signals, lower for more frequent signals

SourcePrice

- Options: PRICE_CLOSE, PRICE_MEDIAN, PRICE_TYPICAL

- Description: Price type used for calculations

- Usage: Choose based on your trading strategy and preference

TakeWicksIntoAccount

- Default: true

- Description: Whether to include price wicks in calculations

- Usage: Set to false for more conservative signals

Core Formula

The SuperTrend indicator uses the following calculations:

|

|

GitHub Repository

The complete source code is available on GitHub:

- Repository: SuperTrend Indicator for MT5

- License: MIT

- Contributions: Pull requests and issues are welcome

License

This project is released under the MIT License, which means you are free to:

- Use the indicator for any purpose

- Modify the code to suit your needs

- Distribute your modified versions

- Use it commercially

Support

For support, bug reports, or feature requests:

- Open an issue on the GitHub repository

- Contact us through the contact form below

- Join our community for discussions and updates

Upgrade to Pro Version

Looking for more advanced features? Check out our SuperTrend MultiTF version with:

- Multi-timeframe analysis

- Higher timeframe trend overlay

- Enhanced customization options

- Professional support

- Regular updates and improvements

Note: This indicator is provided for educational and informational purposes only. Trading involves risk, and past performance is not indicative of future results.